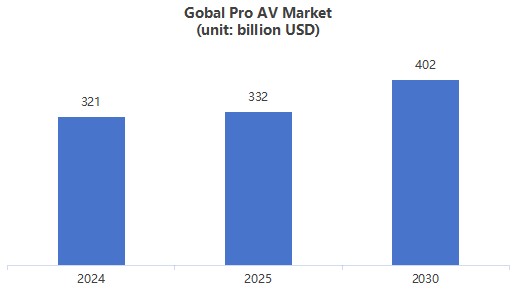

The professional audiovisual (pro AV) industry continues to show resilience and long-term potential, with AVIXA’s latest Industry Outlook and Trends Analysis (IOTA) projecting global revenues to climb from $332 billion in 2025 to $402 billion by 2030. Although growth has slowed compared to earlier forecasts, pro AV is still on track to outpace global GDP, positioning itself as a key driver of technology-enabled experiences worldwide.

AVIXA’s revised forecast reflects the effects of global uncertainties—tariffs, geopolitics, and high interest rates. While the previous five-year projection estimated a 5.3% growth rate, this has been adjusted to 3.9% CAGR through 2030. Despite the slowdown, the pro AV market is still expected to expand by $70 billion in just five years, outperforming the global economy by nearly one percentage point.

Sean Wargo, Vice President of Market Insight at AVIXA, emphasizes that the pro AV sector remains “well positioned for long-term success” as it transitions from post-pandemic recovery to more stable, experience-driven markets such as live events, retail, venues, and hospitality.

Two powerful forces continue to fuel pro AV growth: the hybrid workplace and the experience economy.

The Asia-Pacific region continues to act as the engine of pro AV market growth, but with a significant shift. While China previously led the charge, India has emerged as the standout performer thanks to increased infrastructure investment and a rising demand for immersive, technology-enabled experiences.

Other high-growth regions include the Middle East and Latin America, both of which are seeing robust investments in AV solutions for entertainment, education, and government applications.

The pro AV industry is rapidly evolving, powered by technological innovations that transform how audio and visual solutions are delivered. Four standout trends are:

Among product categories, content management hardware and services remain dominant, but standalone software—especially AI-powered AV tools—is now the fastest-growing segment, reflecting a broader shift toward value-added services and intelligent infrastructure.

From a vertical market perspective, the corporate sector remains the largest buyer of pro AV solutions, though its growth is slowing. Conversely, government, military, energy, and utilities sectors are accelerating adoption, showing the industry’s resilience in recession-prone times.

In terms of AV solutions, conferencing and collaboration technology still leads the way. However, broadcast AV has surged to become the second largest solution area. This shift reflects the rising demand for video content creation capabilities, as companies increasingly view corporate events and brand activations as content that can be shared across both digital platforms and in-person experiences.

Despite macroeconomic challenges, the pro AV industry is expected to remain on a steady upward trajectory, reaching $402 billion by 2030. With powerful trends like the hybrid workplace, experience economy, and innovations in AI, XR, and AV over IP, the sector is evolving beyond traditional AV installations into a dynamic ecosystem that enhances collaboration, entertainment, and customer engagement worldwide.

For businesses, integrators, and end-users, the takeaway is clear: strategic investment in pro AV technologies today will be the foundation for success in tomorrow’s experience-driven economy.