After years of intense price competition, China’s LED industry is entering a new phase of structural adjustment. Price increases are now spreading across the entire value chain, from upstream chip manufacturing to midstream packaging and downstream applications.

This shift reflects deeper changes in cost structures, supply dynamics, and market positioning. Rather than short-term fluctuations, the current adjustments mark a broader reset aimed at restoring long-term sustainability.

The upstream segment forms the foundation of the LED supply chain. It includes epitaxial wafers, chips, and key electronic materials. In recent months, this segment has faced growing cost pressure.

Several factors are driving this trend:

At the same time, prices for core metals such as gold, silver, and copper remain elevated. These materials are essential for electrodes, bonding wires, and conductive layers. As their costs increase, chip manufacturers see their margins compressed.

Over time, upstream suppliers have gradually passed these pressures downstream. This has become the starting point for broader price adjustments across the industry.

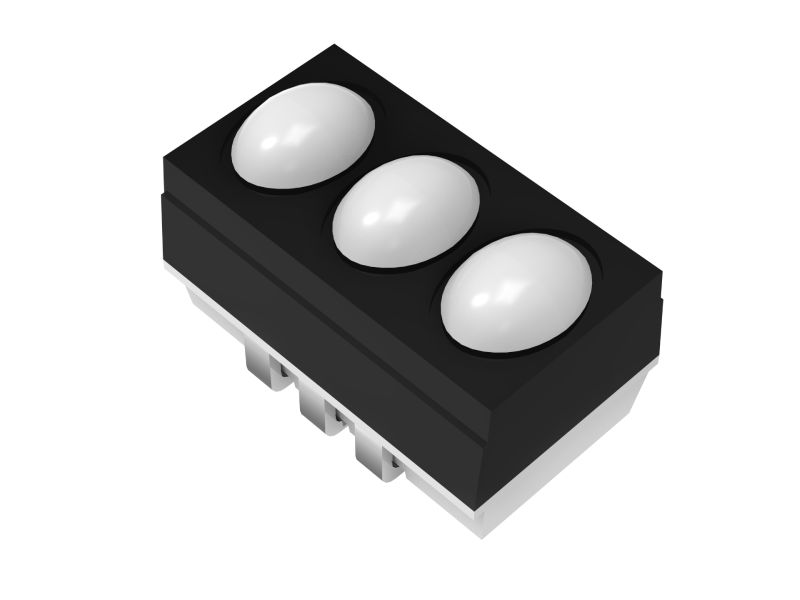

The packaging segment plays a central role in connecting chip production with final product manufacturing. It has also been one of the first areas to implement visible price corrections.

For several years, packaging companies absorbed rising costs to remain competitive. However, this approach has become unsustainable. Expenses related to silver paste, alloy bonding wires, substrates, and PCB materials have continued to rise.

As a result, several mainstream packaging product categories have recently recorded price increases in the range of 5% to 10%. Some specialized models have seen even higher adjustments.

In addition, PCB-related components at certain suppliers have experienced increases of up to 10%, largely driven by persistently high copper prices and tightening supply conditions.

These changes reflect a structural shift rather than temporary pricing moves. Moderate adjustments have become essential for restoring basic profitability and operational stability within the packaging sector.

Downstream segments include LED displays, lighting systems, commercial screens, and smart devices. These markets are closely linked to project investment cycles and end-user demand.

In the current environment, downstream manufacturers face dual pressure. On one hand, component costs continue to rise. On the other hand, market growth remains uneven in some regions.

For a long time, intense competition limited their ability to adjust prices. Many companies relied on volume expansion to offset declining margins. This model is now under strain.

As upstream and midstream prices increase, downstream firms are gradually revising their quotations. Most new orders are being executed under updated pricing frameworks.

Key affected products include:

Although adjustments remain cautious, they indicate growing acceptance of cost-driven pricing mechanisms.

The current round of price adjustments is the result of long-term structural factors rather than short-term market volatility.

Over the past four years, average LED product prices have declined by approximately 30% to 40%. This reduction has far exceeded improvements in manufacturing efficiency. As a result, profit margins have been continuously compressed.

Key input materials remain expensive. Gold, silver, copper, and specialty chemicals all contribute significantly to production costs. In packaging processes, these materials can account for more than 70% of total expenses.

Sharp increases in these inputs directly translate into higher manufacturing costs.

Advanced wafer production and high-end packaging require substantial capital investment. Capacity expansion is therefore gradual. In some segments, supply growth has lagged behind demand recovery, supporting higher prices.

After years of consolidation, weaker players are gradually exiting the market. Meanwhile, surviving companies are shifting away from purely price-driven competition. This encourages more disciplined pricing behavior across the industry.

Despite recent adjustments, margin pressure remains significant, especially for small and mid-sized manufacturers. Many continue to operate with gross margins below healthy levels.

However, the industry is steadily moving toward higher-value segments. This transformation is becoming more evident in areas such as:

These markets place greater emphasis on performance, reliability, and customization. Customers in these segments are generally more willing to accept reasonable pricing based on technical value.

Companies that invest in technology, quality control, and system integration are better positioned to benefit from this shift.

China remains a major hub in the global LED manufacturing ecosystem. Changes in its cost structure therefore influence international markets.

For overseas buyers and system integrators, current trends imply:

For manufacturers, the new environment highlights the need to strengthen cost management, optimize material sourcing, and expand into premium application markets.

Over time, these adjustments may contribute to a more balanced and resilient global supply network.

The recent wave of price increases across China’s LED industry represents a necessary correction after years of margin compression. Rising material costs, capacity limitations, and structural shifts have made this adjustment unavoidable.

From upstream chips to midstream packaging and downstream applications, the entire value chain is entering a new pricing phase. While short-term pressure remains, this reset creates more favorable conditions for sustainable growth.

Looking ahead, companies that focus on innovation, quality, and long-term market positioning will be best equipped to navigate this new cycle. The industry is gradually moving away from pure price competition toward a more value-driven development model.