As the world accelerates toward digitization, the LED display market is undergoing a seismic shift, with 2025 marking a pivotal year for innovation and adoption. Fueled by advancements in materials science, artificial intelligence (AI), and sustainability mandates, LED technology is transcending traditional boundaries. Industry analysts predict the global LED display market will surpass $15 billion by 2025 (Statista, 2023), driven by applications ranging from immersive entertainment to mission-critical smart city infrastructure. This article delves into the technological, economic, and environmental forces reshaping the industry, offering a granular view of future opportunities and challenges.

Mini-LED and Micro-LED technologies are redefining display quality standards. By 2025:

Mini-LED Adoption: Over 30% of premium TVs and gaming monitors will utilize Mini-LED backlighting, achieving 1,000+ local dimming zones for HDR content. Companies like Apple and TCL are integrating Mini-LEDs into tablets and laptops for enhanced color accuracy.

Micro-LED Commercialization: Though currently limited to niche markets (e.g., Samsung’s The Wall), Micro-LED production costs are expected to drop by 40% by 2025, enabling scalable use in cinemas and corporate boardrooms. Key advantages include 0.1mm pixel pitches and 100,000-hour lifespans.

Curved LED Screens: Automotive giants like BMW are embedding flexible LED panels into car dashboards and sunroofs, creating dynamic lighting environments.

Transparent OLED Hybrids: LG’s 77-inch transparent OLED-LED hybrid screens are being tested in retail stores, combining 55% transparency with 4K resolution for futuristic product showcases.

AI-powered LED systems are enabling:

Predictive Content Optimization: Billboards in Tokyo’s Shibuya district now use AI cameras to analyze crowd demographics and adjust ads in real time.

Energy Management: Barcelona’s smart streetlights integrate LED displays with IoT sensors, reducing energy consumption by 35% through adaptive brightness control.

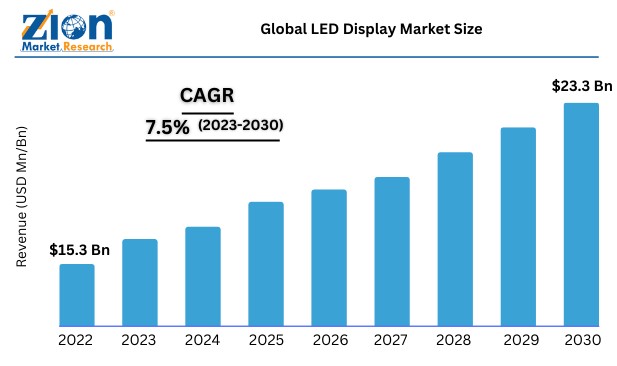

Global LED display market size (source: ZION Market Research)

Interactive Storefronts: Uniqlo’s flagship stores deploy LED floors that change patterns based on customer movement, boosting engagement by 50% (Retail Dive, 2023).

Programmatic DOOH Advertising: Digital-out-of-home (DOOH) ads linked to programmatic platforms will account for 25% of global ad spend by 2025, driven by ultra-HD LED billboards in Times Square and London’s Piccadilly Circus.

Augmented Reality (AR) Stadiums: The 2024 Paris Olympics will debut LED-enabled AR overlays for live audiences, projecting real-time stats onto fields.

Hollywood’s Virtual Backdrop Boom: LED volume stages (popularized by The Mandalorian) are projected to grow at 22% CAGR, replacing green screens for photorealistic environments.

Traffic Flow Optimization: Los Angeles uses LED-equipped smart poles to display real-time traffic data, reducing congestion by 18%.

Public Safety: Seoul’s emergency alert systems employ multilingual LED displays in subway stations, improving crisis response efficiency.

China: Dominates 60% of global LED production, with Shenzhen-based companies like Unilumin leading in COB (Chip-on-Board) technology.

India: Government initiatives like Digital India are driving demand for 1 million+ outdoor LED billboards by 2025, focusing on tier-2 cities.

Healthcare: Surgical theaters adopt 3D LED screens for precision-guided operations, with the market expected to reach $2.1 billion by 2025 (Frost & Sullivan).

Education: 80% of U.S. universities plan to install interactive LED whiteboards by 2025, enhancing hybrid learning experiences.

Regulatory Push: The EU’s Circular Economy Action Plan mandates 95% recyclability for LED products by 2025, pushing brands like Philips to develop modular displays.

Architectural Integration: Paris’s La Défense district uses solar-powered LED façades that cut CO2 emissions by 120 tons annually.

Market Leaders: Samsung’s QD-OLED hybrid technology aims to capture 20% of the high-end TV market by 2025. Leyard’s acquisition of Telerent and Planar Systems strengthens its control over North American rental markets.

Emerging Players: Startups like VueReal (Canada) are commercializing Micro-LED printing techniques, slashing manufacturing costs by 70%.

Collaborations: Sony and Honda’s joint venture, Sony Honda Mobility, plans to integrate full-windshield LED HUDs (Heads-Up Displays) in electric vehicles by 2025.

Rare Earth Dependencies: Gallium and indium shortages (critical for LEDs) may escalate due to China’s export controls, pushing companies to stockpile reserves.

Nearshoring Trends: 35% of U.S. firms are relocating LED component production to Mexico and Vietnam to mitigate tariff risks (Deloitte, 2023).

Recycling Innovations: France’s EcoLED program recovers 90% of rare metals from discarded displays via chemical leaching.

Carbon-Neutral Factories: Leyard’s Chengdu plant runs entirely on hydropower, aligning with UN SDG 7 (Affordable Clean Energy).

5G-Enabled Displays: Verizon’s partnership with Lighthouse Technologies deploys 5G-connected LED billboards with <5ms latency for live event streaming.

Holographic LED: Startups like Looking Glass Factory are prototyping glasses-free 3D LED screens for retail and museums, targeting a $800 million niche market by 2025.

Kinglight 1820-BB LED

The LED display market in 2025 will be defined by three pillars:

Technological Dominance: Micro-LED and AI-driven solutions will set new benchmarks for performance.

Sustainability as a Differentiator: Eco-design and recycling programs will become non-negotiable for market entry.

Hyper-Personalization: From AR billboards to adaptive automotive displays, LEDs will deliver context-aware visual experiences.

Businesses must prioritize agile R&D, supply chain resilience, and cross-industry partnerships to capitalize on this $15 billion opportunity. As the line between physical and digital realms blurs, LED displays will emerge as the canvas for tomorrow’s innovation.